Company-Specific Factors

Why did costco stock drop today – Costco’s recent financial performance has been mixed, with some areas showing strength while others have faced challenges. In the fiscal year 2023, Costco reported a 16% increase in net sales to $222.8 billion, driven by strong demand for its grocery and household essentials. However, the company’s operating income grew by only 8.3% to $5.5 billion, indicating some margin pressures due to rising costs.

Changes in Business Strategy or Operations, Why did costco stock drop today

Costco has made several changes to its business strategy and operations in recent years, including expanding its e-commerce presence, investing in new store openings, and introducing new product categories. While these initiatives have the potential to drive long-term growth, they may have also contributed to the stock drop in the short term. For example, the company’s investment in e-commerce has resulted in higher fulfillment costs, which have weighed on its margins.

The news of Costco’s stock decline today sent shockwaves through the market. However, amidst the financial turmoil, there was a glimmer of hope for Pennsylvania residents. The state’s special license plates, which feature a variety of designs, including scenic landscapes and university logos ( pa special license plates ), became a beacon of pride and solidarity.

Despite the economic downturn, the allure of these personalized plates remained strong, providing a sense of community and a touch of individuality amidst the uncertainty.

Internal Challenges or Controversies

Costco has faced some internal challenges and controversies in recent years, which may have also impacted its stock price. These include allegations of labor violations, supply chain disruptions, and product recalls. While the company has taken steps to address these issues, they may have raised concerns among investors and contributed to the stock drop.

Costco’s recent stock drop may have raised concerns among investors. While the reasons for the decline are being analyzed, it’s worth noting that the company’s overall financial health remains strong. If you’re interested in tracking vehicle information, consider utilizing the pennsylvania license plate lookup service.

By inputting a license plate number, you can access details like the vehicle’s make, model, and registered owner. This tool can be helpful for various purposes, including researching a used car or locating a specific vehicle. Returning to Costco’s stock performance, analysts will continue to monitor the situation and provide updates as more information becomes available.

Economic and Market Conditions

The overall economic climate and market conditions can significantly impact the retail sector, including Costco. Here’s an analysis of the macroeconomic factors and competitive landscape that may have influenced Costco’s stock performance.

Inflation

- Rising inflation can erode consumer purchasing power, leading to reduced spending on non-essential items.

- Costco’s low-margin business model may be particularly vulnerable to inflationary pressures on its operating costs.

Interest Rate Changes

- Interest rate increases can make it more expensive for consumers to borrow money, potentially dampening consumer spending.

- Higher interest rates can also make it more costly for Costco to finance its operations and expansion plans.

Competitive Landscape

- The retail industry is highly competitive, with several major players vying for market share.

- Costco faces competition from traditional brick-and-mortar retailers, online retailers, and discount chains.

- The performance of Costco’s competitors can provide insights into the overall health of the retail sector and the competitive dynamics within the industry.

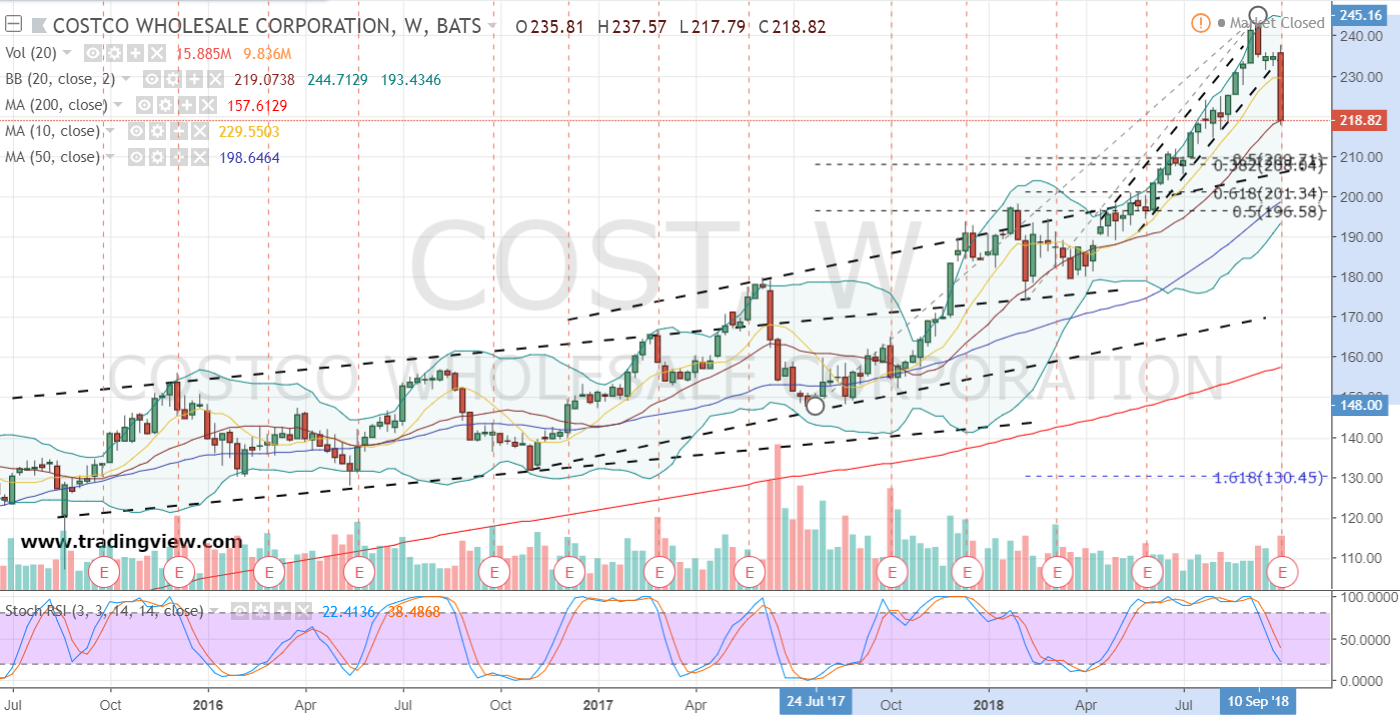

Technical Analysis: Why Did Costco Stock Drop Today

Technical analysis involves studying historical price data to identify patterns and trends that may provide insights into future price movements. By analyzing various technical indicators, such as moving averages, support and resistance levels, and chart patterns, traders can make informed decisions about potential trading opportunities.

Key Technical Indicators

- Moving Averages: Moving averages smooth out price fluctuations by calculating the average price over a specified period, providing a trend indicator.

- Support and Resistance Levels: These are price levels where the stock has consistently bounced off or reversed direction, indicating potential buying or selling pressure.

- Chart Patterns: Recognizable patterns, such as head-and-shoulders or double tops, can provide clues about potential price reversals or continuations.